More tax relief coming soon? The Narendra Modi government, having provided substantial relief in personal income tax and customs tariff rationalisation in the Union Budget 2025, is now expected to initiate efforts to streamline the goods and services tax (GST) framework for easier implementation and adherence, according to officials.

The primary objective will be to restructure the tax slabs to ensure meaningful outcomes, they indicated.

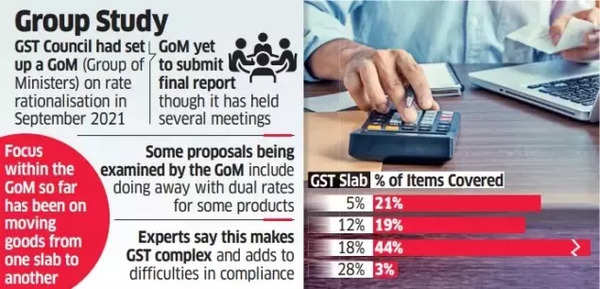

The GST structure comprises four slabs-5%, 12%, 18%, and 28%, with special rates for certain items like precious metals and additional cess on sin goods.

The 5% slab currently covers 21% of GST items, whilst 12% applies to 19%, 18% to 44%, and 28% to 3% of items.

GST reforms on the cards?

According to an ET report, the government intends to discuss simplification and rationalisation with the group of ministers (GoM) tasked with reviewing rates, according to a source close to the discussions.

The source noted that whilst the GoM has primarily concentrated on slab adjustments for goods, a comprehensive simplification requires fundamental restructuring of the current system.

The GST Council established the GoM for rate rationalisation in September 2021. Despite numerous meetings, the GoM has not yet presented its final recommendations.

Also Read | Income Tax slabs 2025-26: How you can pay ZERO tax with Rs 13.7 lakh salary under new income tax regime

The GoM is considering proposals including elimination of dual rates for items like pens and sunglasses based on price thresholds. Specialists have noted these complexities create compliance challenges.

The GST revenue-neutral rate (RNR) has decreased to 11.6% from 15.5% at its July 2017 implementation, due to various exemptions and reductions.

Most experts advocate a three-rate structure for enhanced simplicity and effectiveness.