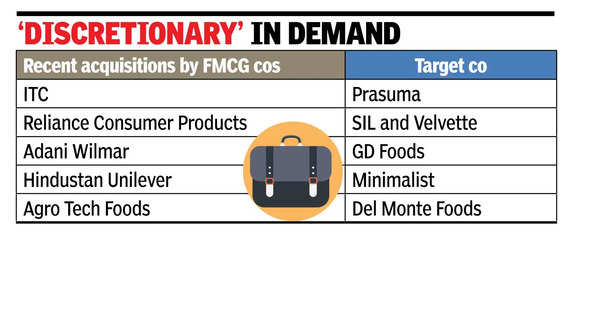

MUMBAI: FMCG companies are out shopping in the market, weighing potential acquisitions. Three months into the year and the space has seen acquisitions by HUL, ITC, Reliance Consumer Products and Adani Wilmar. A subdued market has made valuations more rational, making it a ripe time to buy.

“Corporate CFOs are hungry for M&As as long as valuations are reasonable. The market is soft now and PE (private equity) money is cautious,” said an analyst tracking the sector. Deal activity is higher in the mid-market space – firms are targeting brands in the Rs 100-500 crore (size in terms of revenue) range, Mayank Rastogi, markets leader, strategy and transactions practice at EY India told TOI.

Acquisitions have always been a preferred mode for businesses to expand their market share but over the recent years, the nature of deals have changed – with Indians getting more prone to experimenting in discretionary categories helped by higher disposable incomes, companies are looking to snap up brands operating in high growth spaces like convenience food (includes ready-to-eat/ready-to-cook, frozen food), beauty and personal care (BPC).

HUL, for instance, acquired new-age beauty brand Minimalist at a valuation of Rs 2,955 crore while ITC bought Prasuma which built a credible brand in the frozen, chilled and ready to cook foods space to bolster its foothold in the market, pegged at more than Rs 10,000 crore currently. “A lot of the mainstream FMCG brands have realised that they have not innovated enough. Their R&D pipeline was lacking and inorganic acquisitions is a quick way to grow,” said Anand Ramanathan, partner and consumer industry leader at Deloitte India. Besides, the growth of e-commerce has enabled new brands to set up shops and localise, stepping up supply of brands in the market and allowing larger FMCG brands to fill in certain white spaces, said Ramanathan.

Reliance has been expanding its FMCG footprint largely through acquisitions as it takes on older rivals in a competitive market. Its strategy however, is pivoted around reviving heritage Indian brands-it recently added Velvette and Sil to its portfolio which already includes brands like Campa. The idea to relaunch household brands of yesteryears seems to have worked-Campa, for instance, the company claims, has gained over 10% market share in the sparkling beverages category in certain states. Companies which are eyeing big expansion in tier two and three cities are also targeting regional brands, said analysts.

Big companies are expected to continue to consolidate leading brands in BPC, food and beverages. “These are large sectors and have many regional, traditional, as well as new-age brands who have strong top-of-the-mind brand recall and good scale,” said Neeraj Shrimali, MD and co-head, digital and technology investment banking at Avendus Capital. For some of the selling brands, being part of larger FMCG companies, allow them to have access to a wider offline distribution reach, he added.