MUMBAI: Smartphone makers are joining the 10-minute delivery rush. Brands like Vivo, Samsung, Motorola and Lenovo are testing the potential of quick commerce that has found favour with consumers especially in the metros where they are turning to platforms like Zepto, Blinkit and Swiggy Instamart.

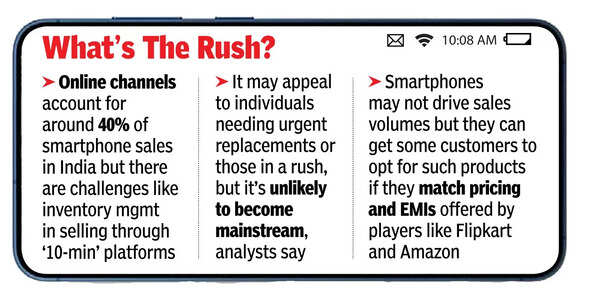

Online channels account for around 40% of smartphone sales in India but there are challenges of selling through 10-minute delivery platforms. Analysts see the trend of smartphones and tablets making their way to quick commerce as more of a marketing ploy by brands.

“Demand for 10-minute phone delivery is likely to remain niche. While quick commerce suits FMCGs and other everyday items, smartphones typically involve higher prices, research and after-sales support, making urgent delivery less relevant. It may appeal to individuals needing urgent replacements or those in a rush, but it’s unlikely to become mainstream,” Shubham Singh, research analyst at Counterpoint Research told TOI.

Vivo has partnered with Zepto to deliver its mobile phones in 10 minutes while Samsung has tied up with Tata’s BigBasket for quick delivery of its S25 series, expanding its coverage in the space. Brands like Xiaomi, Lava have also added quick commerce to their mode of distribution while Lenovo has listed its tablets and monitors on some platforms.

Blinkit, Zepto and BigBasket had also delivered iPhone 16 after its launch in 10 minutes. “In the short term, we foresee faster adoption of accessories, peripherals, tablets and entry level devices given their lower ticket sizes and immediate replacement needs….laptops, gaming PCs and high end computing devices present challenges due to their price points and the consumer’s need for research before purchasing, especially in a market like India, where the average unit price for PCs is over Rs 50,000,” said Dinesh Nair, director, consumer business at Lenovo India, adding that scalability will depend on unit economics and consumers’ willingness to shift their buying behaviour for higher-value items.

For quick commerce firms, smartphones and tablets may not drive sales volumes but they can get some customers to opt for such products if they match pricing and EMIs offered by players like Flipkart and Amazon, said Satish Meena, advisor at Datum Intelligence. For brands, the challenge will be to manage the inventory.

Brands’ move to fray into quick commerce has irked offline mobile retailers. AIMRA (All India Mobile Retailers Association) India founder chairman Kailash Lakhyani told TOI that letters have been sent to firms like Vivo, Xiaomi, Apple and Samsung urging them to cease sales through quick commerce platforms. In one of the letters, AIMRA said that quick commerce does not add value to the brand but disrupts the retail structure and fuels the grey market.